Real Estate Agent Accounting Software

Content

This means keeping your business and personal accounts separately, and not mingling charges between the two accounts. You can ask us at ShoreAgents for help with your real estate bookkeeping work. Our https://www.bookstime.com/ team at ShoreAgents will be available to assist you with all the outstanding bookkeeping plans you might hold. We’ll work on everything from checking on your income sources to reviewing your expenses.

If you’re an inexperienced real estate agent or investor and running all operations from a single account, you have to change your strategy. Think of it as a long-term solution to make tax calculation easier for personal and business operations. With a single account, you will have scrambled data that can create a multitude of problems. The last thing you want to do as a real estate agent or investor is to mix your personal and business accounts. It is a mistake that practically makes it impossible to trace business cash inflow activities.

Accounting Software

Keep copies of all receipts by using a safe and secure online storage system to organize all real estate documents. For example, three years ago the value of a home in Jacksonville, Florida was $184,000 according to Zillow.

Roofstock may receive compensation or other financial benefits from service providers that market on this site, as authorized by law. Tim worked as a tax professional for BKD, LLP before returning to school and receiving his Ph.D. from Penn State. He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University.

Why Outsource Real Estate Bookkeeping to Velan?

Glenn Tyndall is a certified public accountant located in Florida. He owns his own accounting and tax firm that services individuals, small businesses, real estate associations, and more. Glenn is a member of the American Institute of Certified Public Accountants and is a former writer for The Balance Small Business. Now that you know the importance of strong real estate accounting and what to expect in terms of trackable financial information, it’s time to take a closer look at best practices. You need to note how your credit score is working when you manage your business. You will have a better chance preserving your credit score if you can manage your payments and handle your finances. Having a quality credit score is essential for qualifying for loans and for getting more favorable terms on any financial services you might wish to request.

CORE Back Office also features integrations—more than 30—which include QuickBooks and Zoho Dashboards. The products on this list are the best of the best in terms of helping real estate agents and brokers manage business finances. However, not all of the products work well real estate bookkeeping in both situations. We’ve identified the target users for each product and discussed specific functionality related to each where appropriate. FreshBooks helps real estate agents simplify and streamline their processes for easier accounting with more clarity and insight.

Comparison of Best Real Estate Accounting Software

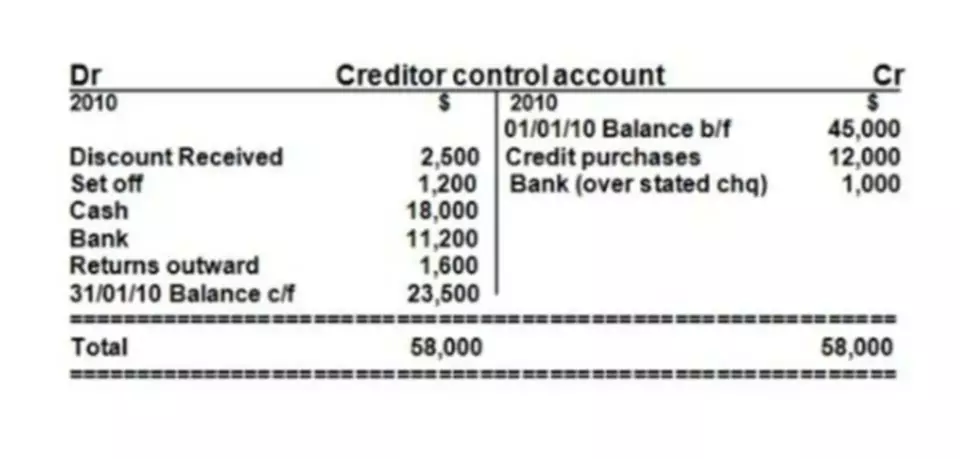

In accounting, a debit increases the value of accounts while a credit decreases the value of accounts . Operating expenses are costs that aren’t directly tied to your services. They differ from your cost of goods sold , which are costs directly related to your services.

Pretty much all businesses, regardless of industry, should achieve a 15 percent profit margin. For me, I place it into my listing cost of goods sold account, but you and your accountant might feel differently. Communication & Technology – this includes all of my communication tools, like email and phone. It also includes any technology to run my business, like my website hosting and CRM. Lead Generation – a simple account for anything related to getting clients. From Zillow leads, to content marketing, to email newsletters, and more.

Easily distracted? Don’t feel bad

The cash method of accounting says you record revenue when cash is received and when expenses are paid out. The accrual method says you record revenue when providing/perform products/services. Whichever you use, you need to maintain accurate financial records and know how to use those numbers. Our CFO services are designed to help real estate companies predict their customer demand and be prepared for it. Our part-time CFOs, take the data from your books, employ financial analysis, to project your future sales. Part-time CFO services also include budgets and overall financial guidance.

Broker Spotlight: Elissa K. Williams, RE/MAX Success – Inman

Broker Spotlight: Elissa K. Williams, RE/MAX Success.

Posted: Thu, 19 May 2022 07:00:00 GMT [source]

The separation of business and personal transactions is one of the most challenging tasks. Bookkeeping for REALTORS from OWL Software is an easy to use accounting software made for realtors. In the real estate business, each realtor is a small business. Rather than having a complex accounting process, Bookkeeping for REALTORS lets you spend more time with your clients so you can earn more commission. Whether you use Paypal or a credit card processor, we incorporate that information into your books and your financial transactions would be entered here..

Taking Advantage of the Home Office Deduction

If you’re new to accounting in any industry, mistakes could be common as you get used to managing financial records and developing a bookkeeping system that works for your personal style. In short, managing your real estate accounting procedures is not just about personal preference. Instead, you must be in compliance with how your county, city, or state regulates real estate income. Having separate business checking and savings accounts also makes it easier to connect them seamlessly to your accounting software or platform.

- With this model, you can clearly see how much money you have within your organization.

- Don’t wait until the end of the year to make adjustments to your business.

- Some are tailored to realtors specifically, but many realtors find success using general accounting software such as Quickbooks.

- But one of the best decisions real estate agents can make is to hire a qualified accountant that understands their unique business needs and can free up a ton of time.

- If you want to succeed as a real estate agent or investor, you will have to dedicate some time to bookkeeping.

- Emphasys’s main goal is to track the commissions paid to realtors, but it also offers accounts payable and receivable functionality, as well as bank reconciliations, reporting, and analytics.

- Little things like looking at a cable bill or consolidating credit card debts can greatly reduce your monthly payment.